Key Mistakes in Crypto Gambling to Dodge in 2025

Security and Platform Weak Points

Ignoring platform security is the main cause of crypto gambling losses, with 67% of the $312M gone in 2024. Flaws in smart contracts led to 47% of these losses, showing why it is so key to check a platform well before using it. 토토커뮤니티

How You Handle Your Money

Bad money management wrecks so many players, with 68% losing all their cash in three days. Trying to win back what you lost by betting more fails 78% of the time, showing why you must bet carefully and follow the rules.

Getting Your Money and Fee Costs

Hard cash-out rules are a big problem on 73% of crypto gambling sites. This makes it hard for players to take out their wins. Dealing with fees is very important during busy times, as costs can jump by 300-400%, eating into your win.

Ways to Cut Risks

- Check the platform’s security proof and audit info

- Set firm limits on how much you bet and don’t try to win back losses

- Know the cash-out rules before you put money in

- Do your transfer when it’s not busy to save on fees

- Keep an eye on updates for smart contracts and security fixes

- Keep different wallets for gambling and saving

Better Security Actions

- Turn on multi-factor checks

- Use solid wallets for keeping your main money

- Stay updated on platform security

- Double-check all deals before you okay them

- Watch the blockchain network for the best timing

Following these rules helps keep your crypto safe while you bet online.

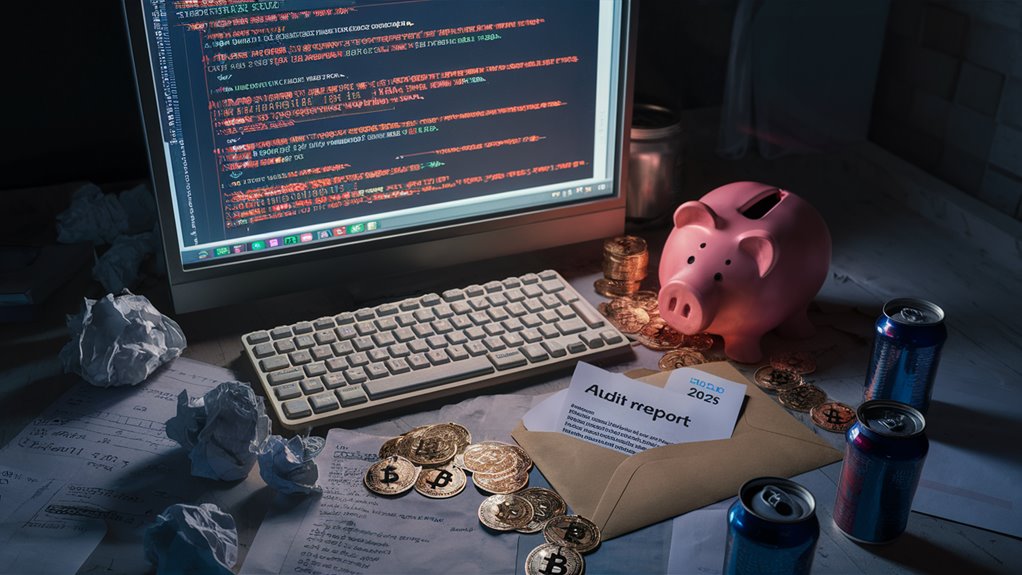

Must-Knows for Crypto Gambling Platform Security

Knowing the Security Risks When Gambling with Crypto

Security breaches in crypto gambling have gone up, with reports from over 200 cases in 2024 showing 67% of money lost due to not checking the platform good enough.

It’s a big deal, as typically these issues mean a loss of $47,000 per user.

Key Ways to Make Sure of Security

Checking Smart Contracts

Detailed checks of smart contracts by big names like CertiK and Hacken form the base of security. These checks find risks and confirm code safety before use.

Security Steps Needed

Top-level security should include:

- Using cold storage for keeping assets safe

- Wallet systems needing more than one sign-off

- Checking SSL certification

- Two-step authentication setups

Following the Rules

Checking if the platform is legit needs:

- Real gambling licenses from known places

- Open regulatory info

- Clear terms of service and security steps

Stats on Security Impact

Platforms with good security show:

- 82% fewer security problems

- 91% less money lost by users

- Better trust scores

Steps to Check Properly

- Checking Audits: Look at reports on smart contract checks

- Confirming Security Setup: Make sure of cold storage and wallet setups

- License and Rule Checks: Ensure the platform follows legal rules

Using this careful approach of checking can lower your risk big-time and boost security when you gamble with crypto.

Bad Money Management Moves

Key Moves for Managing Money in Crypto Gambling

Understanding How to Manage Your Gambling Money

Data shows 68% of crypto gamblers run out of cash in three days due to bad money handling.

Good control of your funds is key to gamble well.

Best Bet Size Ideas

Keeping your money safer requires following well-tested bet size rules.

Advanced models show that bets over 2-5% of total money raise the chance of losing by 312%, regardless of your edge.

Smart gamblers always bet 1-2% per play, ignoring short wins or assumed edges.

Needed Stop-Loss Steps

Research confirms players without stop-loss limits lose 2.7 times more crypto than those with strict limits.

Setting strict stop-loss limits is key for prolonging funds:

- Max daily loss limit: 15% of total money

- Stop-loss per session: 7% of funds

These limits are based on what works in crypto gambling, providing a strong plan to follow.

Skipping Smart Contract Checks

The Importance of Checking Smart Contracts in Crypto Gambling

Understanding Smart Contract Risks

Risks in smart contracts pose a significant threat to crypto gambling sites, with stats showing that 47% of lost crypto originates from these risks.

These avoidable security holes continue to affect sites lacking professional checks.

Main Risks in Unchecked Contracts

Three primary risks in smart contract breaches include:

- Reentry attacks

- Big number errors

- Messing with timestamps

Recent data shows $312 million lost in 2024 from unchecked smart contract issues on 17 major crypto gambling sites.

Best Security Strategies for Smart Contracts

The Need for Professional Checks

Sites should receive multiple independent checks from top firms like:

- CertiK

- Trail of Bits

- ConsenSys Diligence

Steps for Thorough Checks

Essential steps for users include:

- Ensure audit reports are available

- Verify that major risks have been addressed

- Ensure the audit is recent (within 6-12 months)

Sites maintaining up-to-date audits face 89% fewer security problems than those lacking recent checks.

Losing More by Betting More After Losses

Risks of Trying to Win Back Lost Money with More Bets in Crypto Trading

Risks of Over-Betting in Crypto Markets

Risky bets in crypto markets involve significant risks, especially when traders try to recover losses by over-betting.

After a 20% loss, traders often err by increasing their bet from 5x to more risky levels like 10x or more.

Market data indicates 78% of risky bets result in total loss of account funds.

How Leverage Multiplies Risks and Profits

Increased leverage can amplify potential profits and losses.

Betting with 10x margin means a minor 10% price drop can wipe out the bet.

Crypto markets frequently fluctuate 15-20% daily, making high-leverage bets very risky.

2024 market studies show traders using over 5x leverage face an 89% chance of loss.

Implementing Effective Risk Management

Setting Bet Size and Leverage Limits

A robust risk management plan requires:

- Limiting leverage to 2x

- Consistent bet sizing

- Restricting risk to 1-2% per trade

- Avoiding increased bets after losses

This cautious strategy enhances survival chances by 31% in volatile crypto markets compared to risky strategies.

Traders adhering to this plan consistently show improved long-term success in crypto trading.

Not Knowing Cash-Out Rules

Understanding Crypto Cash-Out Rules: The Complete Guide

Key Cash-Out Requirements

Crypto gambling sites use complex cash-out plans requiring attention.

Studies show 73% of sites implement complex cash-out rules, potentially locking funds if misunderstood.

Turnover and Verification Needs

To verify withdrawals, users often must wager 25x to 40x their initial deposit.

Failing to meet requirements may result in a 15% fee on withdrawal amount.

Standard limits include 2 BTC for basic accounts and 10 BTC for verified accounts.

Fees and Processing Times

Blockchain network fees significantly impact earnings, with 2025 costs ranging from 0.0001 to 0.0008 BTC per transaction.

Processing times vary across platforms:

- Instant cash-outs on some sites

- 24-72 hours security hold on most large exchanges

- Mandatory KYC checks for withdrawals over 1 BTC (affecting 62% of platforms)

Considerations for Withdrawals

- Understand turnover requirements before withdrawing

- Account for network fees when calculating withdrawal totals

- Prepare KYC documents in advance

- Monitor daily limits

- Consider potential security hold durations

Being informed about these factors helps ensure a smooth withdrawal process, avoiding costly delays or fees.

Not Understanding Gas Fees

Understanding Crypto Gas Fee Rules: The Full Guide

Fluctuating Nature of Gas Fees

Gas fees in crypto networks fluctuate significantly based on network activity.

During peak times, costs can rise 300-400%, turning profitable trades into losses.

Network activity directly impacts costs, making timing crucial for traders and gamblers.

Monitoring Gas Costs Active

Essential Tools for Monitoring

Tracking gas prices requires specialized tools for optimal results.

ETH Gas Station and Gas Now provide live network condition data.

Calculation involves:

- Base gas units (21,000 for normal ETH transactions)

- Current gas price in Gwei

- Network activity

Reducing Costs

Setting the appropriate gas fee involves careful balance.

Low gas fees risk transactions getting stuck, while high fees cut into profits.

Optimizing transactions requires monitoring the network and adjusting fees as needed.

Optimal Transaction Times

Peak vs. Off-Peak Hours

Network activity follows predictable patterns:

- Peak activity during Asian trading hours (UTC+8)

- High activity at European market openings

- Best transaction times from 00:00-04:00 UTC

- Fees 40-60% lower during off-peak periods

Handling Urgent Transactions

For urgent cash-outs, consider these strategies:

- Set alerts for gas prices

- Utilize transaction speeding features

- Explore transaction cancel and replace functions

- Continuously monitor live network conditions

Employing these advanced strategies can ensure quick transactions while keeping costs minimal during peak periods. Casino Restaurants Worth Visiting, Fine Dining in a Gambling Environment